Get Results, Faster!

Are you trying to be good with money, but not getting the results you want fast enough?

There’s nothing like coaching to get you to take the action you need to take.

As a money coach, I am like a personal trainer for your financial fitness.

Technically you could do it yourself, but I will help you stick to your resolution to improve, and help you get results faster.

Who this is for

Money coaching is for anyone who is struggling on their own to get the financial results they want.

You will especially benefit if this sounds like you:

- I want to get out of debt faster, but can’t

- I want to save more, but don’t

- I want to be in better shape to get a great home loan deal

- I want to build savings to invest

- I’m struggling to manage my fluctuating income

…and I have tried other budgeting methods but not stuck to them.

Key benefits

As mentioned above the key benefit of coaching is that you will get the results you desire faster than on your own.

The financial benefits include:

- Save loan interest (see below example)

- Repay your debt faster

- Achieve your saving goal faster, and thereby earn more interest

- Increase your net wealth

Behavioural benefits that will repeatedly reward you forever:

- Eliminate a debt-fueled lifestyle

- Become good at making spending and saving decisions

- Lay the foundations for wealth creation, as explained below.

Can you afford not to act?

Saving is the foundation of wealth creation and financial independence.

And cash flow control is the foundation of consistently saving.

The journey to financial independence is similar to the journey to physical independence. First babies roll, then crawl, then pull themselves up onto furniture, walk and eventually run.

The journey to financial independence is illustrated below in what I call the Six Stages of Wealth Creation.

Not acting to take control of your spending and to save enough will make it much harder to retire on your terms – when you want with the lifestyle you want. Plus you’ll likely miss out on other important life experiences along the way.

Through coaching we aim to:

- Eliminate a debt-fueled lifestyle, so you’re in control of your money.

- Level you up at least one stage.

I will support you to break unhealthy money habits and embed new healthier habits.

It pays to act now

To be financially fit you need to be earning interest not paying interest.

The average credit card balance accruing interest in Australia is just under $2,000. (Source: RBA stats analysed by comparison website Finder.)

If you have personal debt I can teach you an easy system to:

(1) stop adding to your credit card while you repay your debts

(2) find the extra capacity to repay your debts faster

As illustrated below, you will save thousands in interest and many years by transforming from a ‘revolver’ with a maxed-out credit card to a saver.

I aim to save you more interest than you pay for coaching.

Both good and bad habits compound. The sooner you start the quicker and easier it will be to achieve your goals. And the wealthier you will be.

The right system beats willpower

If you’ve tried ‘budgeting’ before and not stuck to it, it’s not your fault.

We mistakenly think it’s a problem with our willpower. It’s not a character flaw, it’s a design flaw in the system you tried.

Willpower is naturally fickle and unreliable. Even knowing this, often we rely too heavily on willpower when trying to change behaviour and then blame ourselves when inevitably we struggle to stick to our plan.

To be successful in building good habits you’ll need a system that reduces your reliance on willpower and makes success, rather than struggle, inevitable.

Most budgeting advice is wrong

Most common budgeting advice won’t help you change behaviour, which is another reason it’s not your fault.

- It’s not about setting a SMART goal

- It’s not about tracking your spending

- It’s not about budgeting spreadsheets or apps

They are useful tools, but they are not the keys to behaviour change.

- SMART goals help you clearly define what you want but not how to achieve it.

- Tracking your spending tells you where your money went, but budgeting is about telling your money where to go.

- Most free budgeting spreadsheets have a fatal flaw in that they are too focussed on the present and don’t prompt you to set aside money for predictable expenses that are just over the horizon. Many automated budgeting apps share this flaw.

“Your process will determine your progress”

James Clear, Atomic Habits

Being in control of your money is a suite of healthy money habits. It’s a system of behaviours driven by process and supported by tools.

The two keys to designing a system of healthy habits are:

- Design your environment for success

- Harness your emotions

If you have not already done so, read more about the key elements of a budgeting system you can stick to in my free mini-guide.

Don’t be caught out by surprises!

To achieve your goal faster it may seem easy to simply set up a higher automatic loan repayment or saving amount,

But, even automatic savers regularly blow their budgets when they are caught out by surprises.

The thing is that most of these ‘surprises’ are predictable occurrences.

As mentioned above, this is one of the flaws in most budgeting spreadsheets and apps.

I will teach you a budgeting system that helps you ‘plan for the predictable‘ and cater for genuine surprises.

How I developed my budgeting system

Like most Australians, I was never taught how to manage my money. I’m not a natural saver, and I think few of us are.

As a graduate engineer (my first career) I tried the ‘pay yourself first’ method of setting aside 10% of my income. But I wondered how to manage the rest of my income so I didn’t have to think much about it, yet wouldn’t blow my savings.

Frustratingly, there wasn’t a clear single, complete system in any books that I read, nor in my financial planning studies. So I pulled together advice from multiple sources and experimented on myself.

That was over 25 years ago. Since then I’ve developed and refined a cash flow management system that helped me navigate the following life transitions:

- Almost halving my income when I changed careers from engineering to financial planning

- Taking four months unpaid leave to fast track the completion of my financial planning studies

- Divorce and subsequent single parenting

- Self-employment

I’ve successfully taught that same system to clients during my 15 years working as a financial planner. And I’d love to share it with you.

“Working with Matt has really changed my life!

Matt made budgeting very easy to understand and offered great support as I implemented his system, providing valuable insight and advice.

The system Matt taught me has given me a new sense of clarity, freedom and confidence. I finally feel that financial management is no longer a burden.

Matt’s expert help has been money well spent!”

Leah Dowsett

Coaching clientWhat you get

In the Budgeting Bootcamp, you will receive:

- System – a core money management process and tools to get you started

- Support – to personalise the system

- Accountability – to stick to the system until it’s natural and automatic

- Results – if you take action

Budgeting bootcamp structure

One or two coaching sessions may teach you a budgeting technique but sticking to it in the face of temptation is where it really gets tricky.

That’s when a coach can provide you with support and guidance to help you navigate those challenges.

That’s why I’ve structured the money coaching as a three-month bootcamp, which includes up to six fortnightly coaching sessions.

The budgeting bootcamp includes six projects to help you get financially fit:

- Why Change

- Where it All Went

- Tell it Where to Go

- Define Affordable

- Trim the Excess

- Self-sufficiency

- Bonus Project ‘Level Up’

We will meet online using Zoom video conferencing. Maintaining the regular rhythm is very important to embedding new habits and meeting virtually makes it much easier to align our calendars.

Since we are meeting online I welcome clients from anywhere in the world.

Results

During the ‘Budgeting Bootcamp’ we collaborate to:

- Eliminate a debt-fueled lifestyle

- Save you more in loan interest than you pay for coaching

- Get you on track to afford a life goal that really matters to you

- Level you up at least one stage in the six stages of wealth creation

- Become good with money

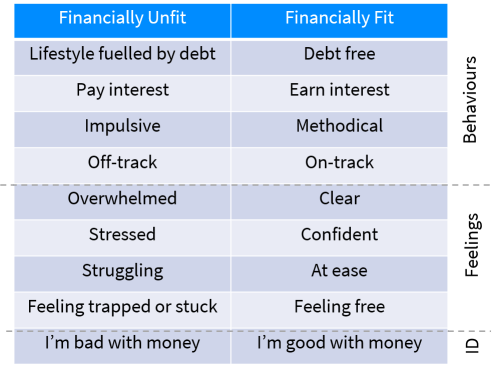

The below table adds some colour and depth to what it’s like to be financially fit and good with money.

Book a Discovery Conversation

Book a complimentary 30-minute discovery conversation to ask me any questions and explore if the Budgeting Bootcamp is right for you right now.

Ideally, the discovery conversation is conducted online using Zoom video conferencing, but phone can work too.

To book either call me on 0400 225 955 or complete your details below.